Why Budgeting Sucks! Track Your Net Worth Instead

A few years ago, I was a personal trainer with variable income. Essentially each month, the money going into my account changed. All the budgeting rules and tricks I read in books and blogs never applied. When I switched to tracking my net worth, only then was I able to get a grasp on my finances and eliminate $14K of credit card debt.

That is a much longer story. Let’s dive into the benefits of using a net worth calculator.

Before I forget: This is not financial advice. This is just info coming from a man who enjoys life with no friction.

What does net worth mean?

Net worth is the total value of everything you own, minus everything you owe. It’s the sum of all of your assets and liabilities. It’s a powerful metric to use to plan and track your financial journey and manage your money.

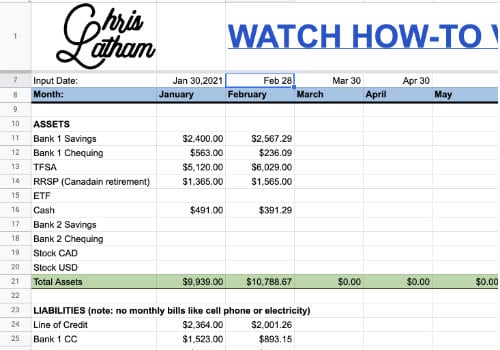

If you are serious about managing your finances, I have a free downloadable spreadsheet that you can use. This is the same one that I use to manage my own money.

Budgeting is wack!

Let me be clear budgeting isn’t a bad idea. Just like a meal plan, it makes sense on paper. The challenge lies in the application of the budget. I’m sure you’ve done a budget before, and you sat down and planned out every dollar that you were going to spend and save. You know, doing the right thing and being proactive.

The issue in being proactive with your budget is that you cannot predict the future. By this, I mean car breaking down, medical bills, having the kids.

The list is endless that things come up out of nowhere that can quickly throw your budget off track.

Budgeting only works if you know how to apply it if you know how to make a plan and adapt as needed.

What if instead of setting yourself back by spending days or weeks creating a budget, you didn’t have to?

Let’s look at a better way…

Why track your net worth?

You want to track your net worth because it helps you understand where you stand financially. You want to know if you’re making positive or negative gains.

Using a net worth spreadsheet is one of the most effective methods to assess your entire financial health. It’s about taking a step back and looking at the big picture of your finances.

Your net worth analyzes everything rather than focusing on just one thing.

On a personal level tracking my net worth monthly in a spreadsheet made it easier for me to pay off my debt. I was seeing the liabilities section go down month after month motivated me to bring it down to 0!

How do you keep track of your net worth?

The simplest way to get started is to pull out all your statements and organize them into an assets pile and a liabilities pile. Once a month, you will add up all your assets and liabilities.

What is the difference between an asset and liability?

A liability is something a person or company owes, usually a sum of money. Liabilities are settled over time through the transfer of economic benefits, including cash, goods, or services. (Investopedia)

An asset is a resource with economic value that an individual, corporation, or country owns or controls with the expectation that it will provide a future benefit. (Investopedia)

Simply put, assets put money in your pocket, and liabilities take money out.

What to include in your net worth?

When it comes to calculating net worth, everyone has a different opinion on which assets to include. For assets, you will want to include:

- Cash

- Bank accounts

- Investment properties (property in your name where the cash flow is greater than your mortgage)

- Investments (gold, stock, crypto, wine, retirement fund, and more.)

- House (only if paid in full. Mortgage = debt)

As for liabilities, it is pretty simple. If you owe money towards it, then add it. For liabilities, you will want to include:

- Credit cards

- Car payments

- House/Condo Mortgage (I don’t care what you say, as long as you’re paying the bank monthly, it’s a liability)

- Rent

- Credit line

- Taxes you owe

Using the net worth spreadsheet

My goal is that the spreadsheet is easy to use. You can change the row labels to match your account. The colourful rows at the bottom are all preset with a formula to take the thinking out.

Watch the video, download your copy of the spreadsheet and stay on top of your finances. If this helped, or you have any questions, leave a comment below.